– here are seven reasons for optimism

Dr Shane Oliver – Head of Investment Strategy and Chief Economist, AMP Capital

Key points

-

With growth of 1.8% in the March quarter, Australian GDP is now back above its pre pandemic level.

-

While uncertainties remain – including around the latest coronavirus outbreak in Victoria – there are seven reasons for optimism that the recovery will continue at a decent rate: vaccines; global growth is ramping up; consumer spending is well supported; dwelling investment is likely to remain strong; business investment is strengthening; fiscal stimulus is continuing; and monetary policy remains ultra-easy.

Introduction

After a far stronger than expected rebound from the national pandemic lockdown through the second half of last year, Australian growth slowed a bit in the March quarter but is now above its pre pandemic level. This note looks at the outlook.

The recovery has slowed but continues

The March quarter saw GDP growth slow but to a still very strong 1.8% quarter on quarter. The gain was driven by a 1.2% rise in consumer spending with a rotation back to services spending (up 2.4%) offsetting a fall back to more normal goods spending (down 0.5%), a 6.4% rise in dwelling investment, a 3.6% gain in business investment and a 0.8 percentage point contribution from inventories offsetting a detraction from trade.

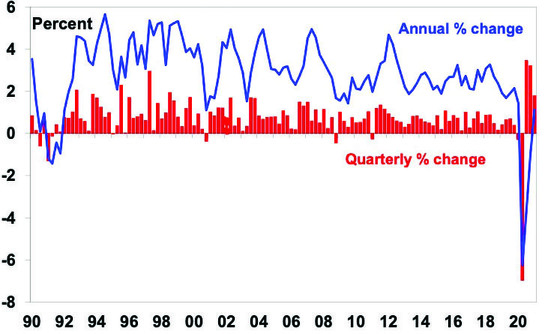

Australian real GDP growth

Source: ABS, AMP Capital

This saw growth up 1.1% on a year ago and GDP has now made it 0.8% above its pre pandemic high in December quarter 2019. As can be seen in the next chart, the economy has effectively traced out a Deep V style rebound. With growth averaging over 3% over the September and December quarters some slowing in the pace of recovery was inevitable as the easy gains from economic reopening are behind us. What’s more, various snap lockdowns across most states impacted over the last quarter. With the reopening gains behind us, the Victorian snap lockdown and potentially others impacting this quarter and some sectors remaining slower to recover – notably travel and higher education given closed international borders – the pace of growth is likely to slow further over the year ahead.

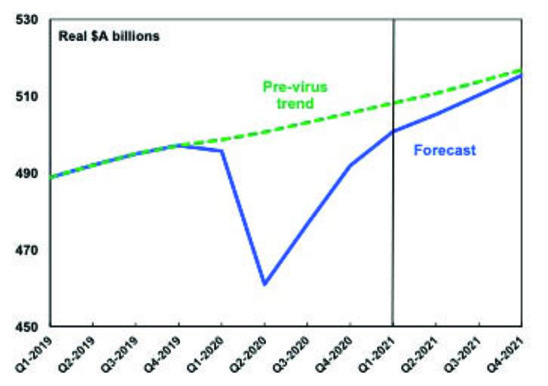

Australian real GDP level

Source: ABS, AMP Capital

The ongoing hit to immigration means it will take longer for Australia to regain its pre-virus trend compared to other countries that normally have relatively lower immigration levels.

Australia has performed relatively well

That said, Australia has performed comparatively well through the pandemic. While China is ahead, Australia is one of the few developed countries with GDP back above pre pandemic levels.

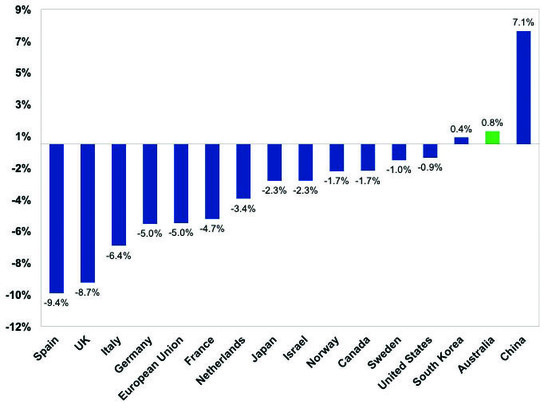

March qtr real GDP, % from pre-CPVID levels

Source: OECD, ABS, AMP Capital

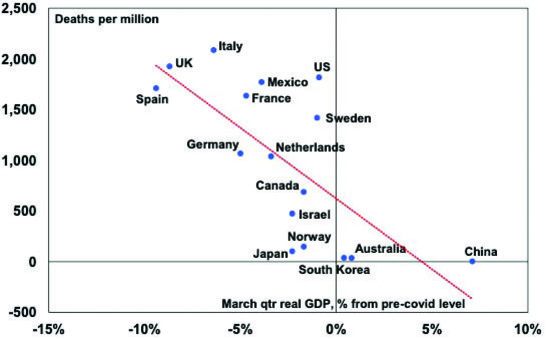

This reflects a combination of better control of coronavirus – which meant lower hospitalisations and deaths, less severe lockdowns and less self-regulation limiting mobility – and a good well-targeted policy response that protected incomes, jobs and businesses. Countries with less coronavirus related deaths like Australia have had better GDP outcomes.

Real GDP growth, % from pre-COVID levels v COVID-19 deaths per million people

Source: ourworldindata, OECD, ABS, AMP Capital

Seven reasons for optimism on Australian growth

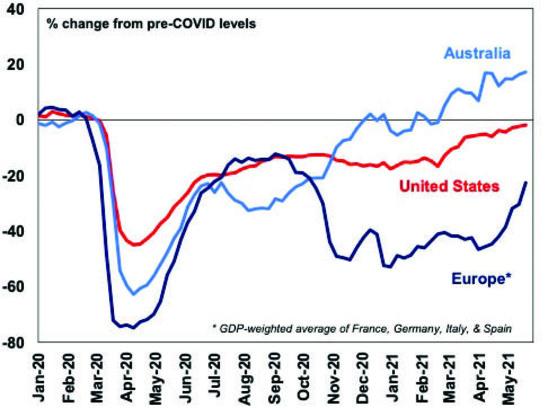

Our Australian Economic Activity Tracker – based on weekly data – has continued to trend higher into this quarter and remains strong relative to our US and European Trackers.

Economic Activity Trackers: Australia, Europe & US

Source: AMP Capital

Uncertainties remain: Australia is vulnerable to new coronavirus outbreaks given the low level of vaccination (just 17% versus 51% in the US and 59% in the UK) as highlighted by the problems in Victoria; some parts of the economy are a long way from normal; and tensions with China could escalate further. However, there are seven reasons for optimism that recovery will continue at a decent rate.

-

First, the vaccines will help in underpinning reopening and recovery – they work in protecting against coronavirus infection and severe illness (as evident in Israel, the UK and US), global vaccine production is ramping up with plentiful global supply likely in the next 6-9 months and Australia appears to be speeding up its vaccine rollout with the events in Victoria helping to spur it on. We are assuming the Victorian lockdown will be successful in heading off a bigger problem and so will be relatively brief. But the uncertainty around outbreaks will diminish as vaccination ramps up.

-

Second, global growth is recovering rapidly – driven by vaccines enabling reopening, monetary and fiscal stimulus, and pent-up demand. This is driving strong growth in demand for Australian exports and high commodity prices.

Global Composite PMI vs World GDP

Source: Bloomberg, AMP Capital

-

Third, growth in consumer spending is well supported – by high levels of consumer confidence, a still high saving rate of 11.6%, excess bank deposits of over $200bn (spread across the household and corporate sectors) relative to what would have occurred in the absence of the pandemic, positive wealth effects from the rise in the share market and house prices, ultra-low interest rates and further to go for services spending to recover.

-

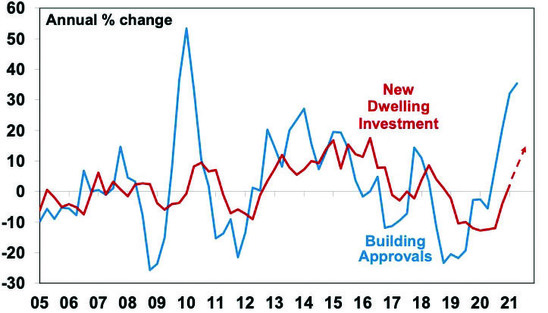

Fourth, dwelling investment will provide a strong contribution to growth – the surge in building approvals points to more upside in housing construction this year.

Building approvals v new dwelling investment

Source: ABS, AMP Capital

-

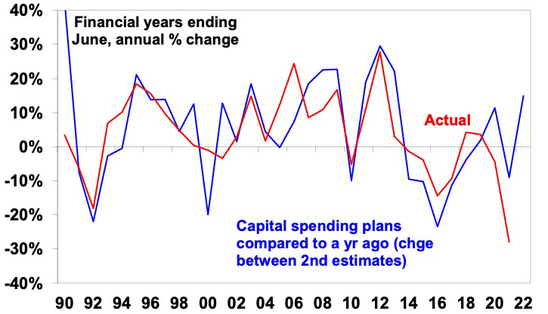

Fifth, business investment is strengthening – investment plans for the next financial year are up nearly 15% on plans for a year ago which is consistent with high levels of business confidence, excess corporate cash and the instant asset write-off tax break. Adjusting business intentions for the past average gap between intentions and actual outcomes points to investment growth of around 20% in the next financial year with mining investment the strongest but manufacturing and other industries also strong.

Actual and expected capital expenditure

Source: ABS, AMP Capital

-

Sixth, fiscal stimulus continues – Australia has successfully negotiated the so-called fiscal cliff with the wind down of JobKeeper and other supports, and fiscal stimulus looks set to continue for now including extra stimulus in the May Budget.

-

Finally, monetary policy remains ultra-easy – while the RBA is likely to cut its quantitative easing in the next 6 months, rates are likely to remain around zero for the next few years.

Concluding comment

We expect GDP growth through this year of 5% and 3.5% next year. This in turn should underpin an ongoing rebound in corporate profits which, along with continuing low interest rates, will underpin a still rising trend in the Australian share market – notwithstanding the risk of a correction in the next few months. Key risks to keep an eye on are: coronavirus outbreaks; a likely further near term inflation scare; and tensions with China.

Important note: While every care has been taken in the preparation of this document, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) make no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided.