It’s important to prepare for unexpected illness that could throw your retirement plans off course.

When you close your eyes and think about retirement, what comes into your mind?

Lounging on a pristine beach in the Whitsundays? Enjoying a croissant in a café on the Champs Elysees? Kitesurfing on the bay?

If you’re approaching the finish line, chances are that you’re getting proactive and eagerly preparing for life after work, with holidays, projects, hobbies and activities to fill your days of freedom.

Whether it’s new destinations, new hobbies or new experiences, your dreams need funding.

By working hard, investing wisely and taking full advantage of any government tax breaks along the way, you’ll give yourself every chance of making your dream retirement a reality.

But along the way you’ll need to think about planning for the unplanned in retirement.

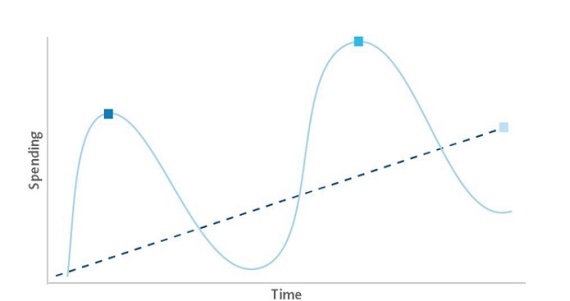

Spending needs can fluctuate in retirement

Your spending is unlikely to stay the same throughout retirement. For many Australians spending is U-shaped—greater when you start retirement, then reduces, then peaks again.

This is because:

-

you tend to spend more when you’re healthy, active and celebrating the end of work

-

your spending slows down during a consolidation period in the middle

-

your spending spikes later in life as health care and aged care costs pick up.

But some people in retirement don’t experience a consolidation period, as unexpected illness takes them straight from spending on hobbies to spending on health care.

The reality of getting older means that you need to react and be prepared for unexpected hurdles. While it’s difficult to think about, health problems can throw your retirement plans off course.

And with Australian grandparents contributing the equivalent of $3.94 billion a year in childcare costs, unexpected illness can have a severe impact on your extended family too.

Claire’s story

Claire1 works at AMP. This is her family’s story.

“My parents were all set up to enjoy their dream retirement. They were enjoying spending time with their grandchildren, they were actively pursuing new hobbies and they had an overseas trip planned.

And then everything changed when Mum was diagnosed with breast cancer. She was only 61 years old. She’s now on chemo. Meanwhile, Dad is going through a second bout of cancer at 68.

In many ways we’re lucky.

I have three brothers and sisters to help look after Mum and Dad.

My job is flexible so I can work from home once a week to help Mum with her medication and drive her to appointments.

And Mum and Dad were always prudent with their money so they have a good savings buffer as well as insurance in place.

But life has certainly changed. We’ve gone from a situation where Mum and Dad helped look after the kids twice a week to looking after them instead.

It’s a tough time and we’re pulling together as a family to help Mum and Dad get through it. But it’s certainly not the retirement we all envisaged for them.”

Planning for every stage of retirement

So what does this mean for your retirement plans?

It’s important not only to budget for the initial active period of retirement, but also for when you may need to spend more on aged care and health care.

Please contact us on PH: 0437 782 836 we can guide you to.

-

Find out how much you might need in retirement.

-

Learn how to manage your money in retirement.

-

Discover your retirement career.

And it’s not just about the money…it’s about your overall quality of life.

-

What happens if your health deteriorates? You may need to think about whether you have enough health cover and life insurance.

-

What happens if you lose your mobility? You may need to look at renovating your home to help you get around or even relocating to be closer to services or family.

-

What happens if you become isolated? Unfortunately it’s easy to lose touch with friends after leaving the workforce so it’s important to stay connectedand active.

After a lifetime of hard work and finally reaching the finishing line, it’s tempting to go hard early and spend up big in the first few years.

But if you’re properly prepared with a sound financial buffer and a prudent retirement spending plan then it makes it easier to navigate uncharted waters.

[1] Names have been changed.

Important:

This provides general information and hasn’t taken your circumstances into account. It’s important to consider your particular circumstances before deciding what’s right for you. Although the information is from sources considered reliable, we do not guarantee that it is accurate or complete. You should not rely upon it and should seek qualified advice before making any investment decision. Except where liability under any statute cannot be excluded, we do not accept any liability (whether under contract, tort or otherwise) for any resulting loss or damage of the reader or any other person.

Any information provided by the author detailed above is separate and external to our business and our Licensee. Neither our business, nor our Licensee take any responsibility for their action or any service they provide.

Any links have been provided with permission for information purposes only and will take you to external websites, which are not connected to our company in any way. Note: Our company does not endorse and is not responsible for the accuracy of the contents/information contained within the linked site(s) accessible from this page.