Income investors have, once again, something to be optimistic about. After a few years where falling interest rates drove up the valuation of profitless concept stocks1, investors who prefer their companies to generate meaningful cash flow have once again enjoyed a period strong of performance2. Since the start of October 2020, the traditional barometer of income stocks – the major banks – have outperformed the ASX200 by over 20%3. Dividends are recovering at a rapid rate and we believe income and value managers are once again looking attractive.

This recent performance is not expected to be short lived either. February was one of the strongest reporting seasons for dividend upgrades on record, and company fundamentals suggest the dividend recovery has further to run4.

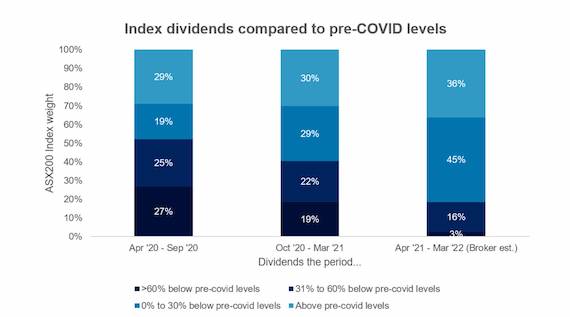

Despite the Australian equity market being within striking distance of its all-time highs, nearly two thirds of the S&P/ASX200 index still have dividends at levels below where they were pre-pandemic, as shown in the figure below. We believe there should be ample headroom for dividends to grow as economies re-open and companies regain the confidence to increase payout ratios. In our opinion, this backdrop should support the strongest outlook for dividend growth in a decade.

Source: FactSet. As at 9 April 2021. Past performance is not a reliable indicator of future performance.

By way of example, if we assumed that all companies with dividends currently below historical levels were to return to pre-pandemic levels, market dividends would be 22% higher than what brokers currently expect5.

This growth outlook is broad based as well, with all GICS sectors – except for materials and utilities – forecasted by brokers to grow dividends over the next two years6.

The yield heroes of tomorrow

Despite the more positive backdrop, income investing remains a difficult but rewarding art to master. In our opinion, the challenge is that dividend payouts generally lag company performance. Dividends are often the last thing to be cut when a company faces tough times and the last thing to return when its outlook improves. By the time dividends move, it’s often too late for investors – the company’s share price has already long since moved.

This does not mean income investing is a bad idea, on the contrary, we believe dividend income is an ideal option for investors seeking yield, it just means that to do it well investors should focus on tomorrow’s yield heroes, not today’s. In our opinion, investors should focus on where dividends are going, not where they are currently.

Income investors who did well in 2020 recognised that some of the best income stocks sometimes actually have no income at all. Many companies, including many retail and health care stocks, completely cut or deferred dividends in the first half of 2020, but many of these stocks are now expected to pay a dividend close to or above pre-pandemic levels over the next twelve months7. In our opinion, investors who were prepared to buy when yields were low should now be able to enjoy higher yields when dividends return.

With nearly two thirds of the index still having dividends below pre-pandemic levels, we believe the outlook for income investing is positive. Nonetheless, the game is changing though. It is now important to recognise which companies have dividends that can exceed, not just return to, its pre-pandemic levels. In our opinion, it is about finding the companies that can be the yield heroes of tomorrow.

1. FactSet, AMP Capital

2. FactSet, AMP Capital

3. FactSet. As at 9 April 2021

4. FactSet, based on broker consensus. As at 9 April 2021

5. FactSet, based on broker consensus. As at 9 April 2021

6. FactSet, based on broker consensus. As at 9 April 2021

7. FactSet, based on broker consensus. As at 9 April 2021

Reproduced with the permission of the AMP Capital. This article was originally published at https://www.ampcapital.com/au/en/insights-hub/articles/2021/april/the-dividend-renaissance-is-no-flash-in-the-pan

While every care has been taken in the preparation of this article, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) (AMP Capital) makes no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This article has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this article, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent of AMP Capital.

This article is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest.