A further rise in COVID-19 cases around the world is leading to questions about the need for another round of government-mandated lockdowns. Given that there are arguments for and against government lockdowns, we look at what the actual economic outcomes have been in both cases in this Econosights.

The backdrop

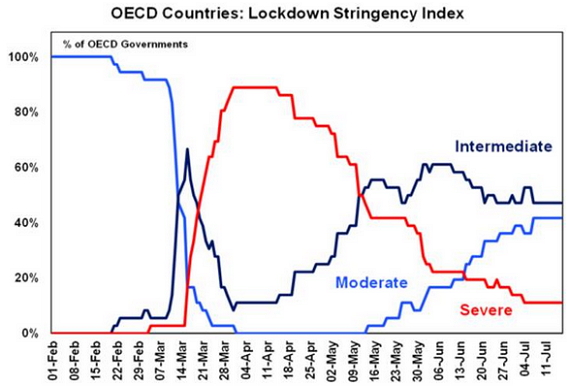

After the majority of the world went into a strict “stay at home” lockdown over late March-April, a lot of these restrictions have now been lifted. Most economies are now operating with “intermediate” lockdown stringencies (see chart below) which generally means that there are social distancing restrictions in place across public venues and on transport along with restrictions on gatherings.

Source: Oxford University, AMP Capital

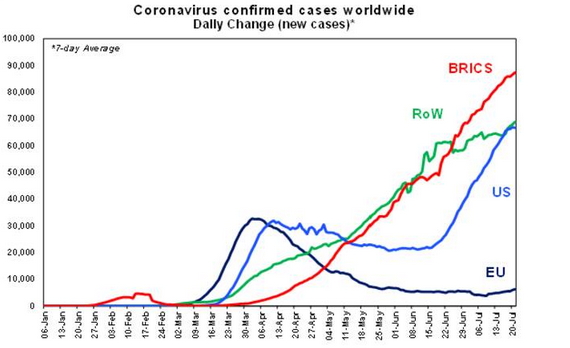

The first round of severe lockdown restrictions worked well to “flatten the curve” to reduce COVID-19 cases, to prepare the hospital system with protective equipment and testing tools and to get the contact tracing system in place. But as several countries started to open up their economies again over late May and June, COVID-19 cases started to spike again (see chart below).

Source: ourworldindata.org, AMP Capital

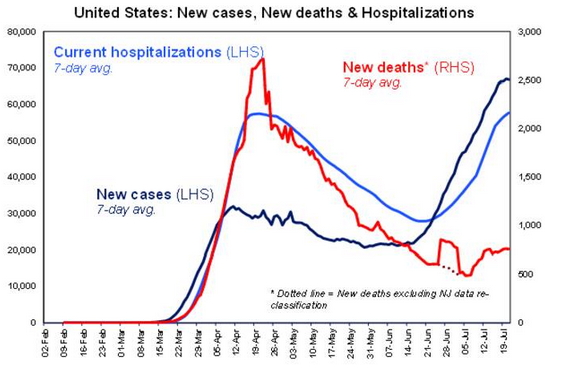

It always seemed highly improbable to completely eliminate the virus without a vaccine so it was always expected that there would be pockets of COVID-19 cases once the economy opened up again. However, the problem now is that some second waves of the virus in places like the US and Australia have higher case counts compared to the first round. While the US fatality rate is not as high this time round (see chart below), hospitals in some states like Arizona, Florida and Texas are getting overwhelmed with COVID-19 cases, and deaths will get worse from here as they tend to lag behind new cases.

Source: The Covid Tracking Project, AMP Capital

Should countries experiencing a second wave (or an extension of the first wave) re-impose lockdown restrictions again? Lockdown measures would reduce deaths and help the hospital system. On the other hand, lockdowns lead to closed businesses and higher unemployment. Both points of view are valid. However, the experience of COVID-19 around the world has demonstrated that in both cases, there is a big fall in consumption as households self-regulate their behaviour.

Sweden’s experience

Sweden did not impose any strict “stay at home” lockdowns (restrictions including things like social distancing at public venues and banning groups larger than 50 people) at the start of the pandemic, instead opting for a “herd” immunity approach (where you need the majority of the population or ~60% to become infected before the country has some long-term immunity to the virus) and expecting that some people would decide to self-regulate their behaviour.

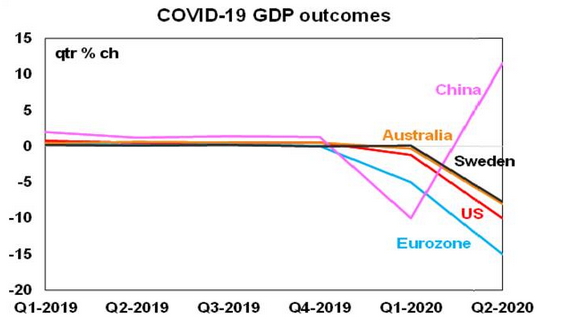

In theory, less lockdowns of businesses means better economic outcomes. But, interestingly Sweden hasn’t made a strong case for this argument. June quarter GDP growth is still expected to have a steep decline (see chart below) but it does appear to have been better than the falls in the US and Eurozone, and around the same as Australia (but Australia had a strict lockdown for around 5 weeks).

Source: Bloomberg, AMP Capital

A herd immunity approach also argues that the outlook for economy overall ends up stronger because lockdowns do not have to stop and restart cases rise and fall. But it is still unclear what achieving herd immunity actually looks like, with the main questions being what proportion of people actually need to get infected before herd immunity is achieved and how long does immunity last? Not enough is known about COVID-19 to answer these questions. And widespread accurate antibody testing to assess population immunity is still not widely available.

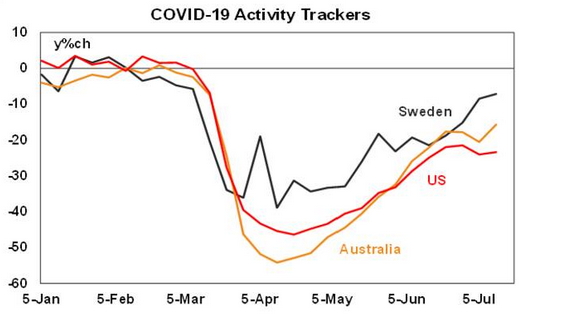

So far, the Swedish forward-looking economic indicators and high frequency data are still pointing to subdued near-term activity. High frequency indicators (like daily consumer spending transactions, hotel bookings, mobility and restaurant bookings) didn’t fall as much as the US and Australia but the bounce back has also been slow (see chart below), just like in the US and Australia.

Source: AMP Capital

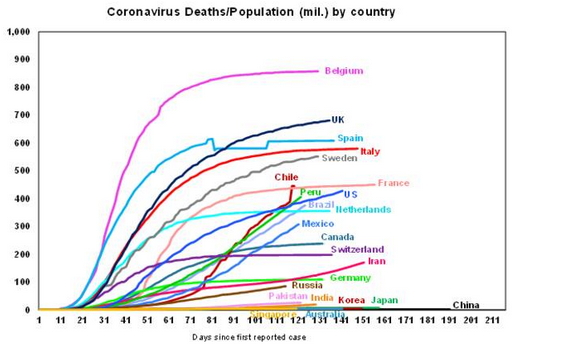

Finally, the most important factor to consider in the lockdown debate is the cost of human life, or the death toll. Sweden has had around 550 deaths per million in the population (see chart below), one of the highest in the world (US is 428 deaths/million and Australia is 5 deaths/million). So, Sweden’s experience of similarly poor economic outcomes against a high death toll doesn’t leave much to be envied.

Source: ourworldindata.org, AMP Capital

Some interesting research from Australian professors at the University of New South Wales have estimated the costs of lockdowns against the benefit of saving lives, which can actually be measured by statistical agencies – known as the cost of a “statistical life”. On these estimates, the costs of lockdowns tend to be greatly exaggerated in the media and by politicans. On their numbers, the cost of lockdown in Australia is around $90bn, but this is heavily outweighed by a much larger ($1.1tn) economic benefit in saving lives.

Household surveys have shown that on average, households do tend to support lockdown measures. In a survey of US houesholds in June (from CivicScience), around 62% of households (on average) supported returning to lockdown as a strategy to reduce rising COVID-19 cases.

Suppression or elimination of COVID-19?

Without a vaccine, there appears to be no way to completely eliminate COVID-19 while it is still circulating around in parts of the world. So suppression of the virus is the only strategy from here. But, lockdowns may still be required in localised areas if case growth becomes too unsustainble, which is what happened in Melbourne.

The economics of lockdowns show that they aren’t as disastrous for the economy as initally assumed. The pandemic will lead to a big hole in economic output with or without lockdowns. It means that more government support is required to fill this hole in economic output. While this means a build up of government debt, the low inflation environment and record low borrowing costs mean that government debt repayments are sustainable for now.

Author: Diana Mousina, Economist – Investment Strategy & Dynamic Markets, Sydney Australia

Source: AMP Capital 23 July 2020

Reproduced with the permission of the AMP Capital. This article was originally published at AMP Capital

Important notes: While every care has been taken in the preparation of this article, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) (AMP Capital) makes no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This article has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this article, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent of AMP Capital.