If your goal is to save for the future, or perhaps start putting away for your children’s education – then unless you plan on putting your savings under your mattress, the sooner you start the better.

That’s because you could be missing out on earning compound interest along the way that could make a stark difference to the overall amount you save.

The difference between simple interest and compound interest

There are two main types of interest:

Simple interest is where a one-off interest payment is made at the end of an agreed, set period of time.

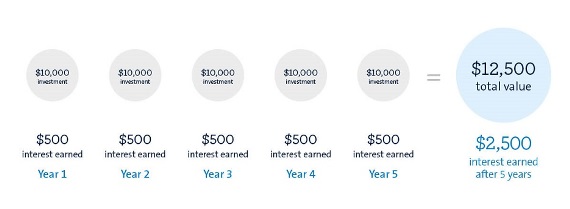

For example: if you invest $10,000 in a term deposit at 5% interest per annum, and don’t withdraw any money, then you’ll have $12,500 at the end of 5 years. That’s because the 5% annual interest rate is worked out based on the value of the initial investment and paid in full at the end.

Simple interest earnings over five year

Compound interest is where interest is paid in regular intervals, building on top of earlier interest paid. The result is a snowball effect of interest earning interest.

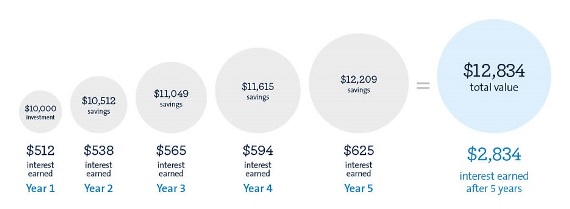

For example, (using the same figures as the simple interest example above), an initial investment of $10,000, earning 5% interest per annum with compound interest paid monthly, will give you $12,834 after five years. That’s because every month the interest earned was earning more interest.

Compound interest earnings over five years

Compound interest will continue to build on itself in this way, assuming nothing changes. How quickly it grows will depend on when you start your savings plan, what the interest rate is, and whether you make contributions (or withdrawals).

How to work out compound interest on your savings

The easiest way to work out how much compound interest you could earn on your savings, is to use an online compound interest calculator, that can do it for you.

Saving for the future

If you’re interested in using compound interest to help your savings grow, then the sooner you start, the better. That’s because, like any good snowball, the earlier it starts rolling, the more snow it will collect along the way.

For example, if you were keen to put aside money for your child’s education, and from the day your child was born, you put $10 per week into a bank account paying 6.25% pa, then by the time they turned 25, their savings would be $31,259. Of that, the interest earned would be $18,372 – outweighing the overall deposits made along the way.

If you started saving later, when your child turned 10, with a first deposit of $5,000, then by the time your child turned 25, they would have savings of $25,611. Of that, the interst earned would be about equal to the overal deposits made, and your savings would be about $6,000 less than if you’d started earlier, without an initial deposit.

This example uses the ASIC Money Smart Calculator1 featuring an effective interest rate of 6.43%. It’s important to remember that a model is not a prediction and uses assumptions. Results are only estimates, the actual amounts may be higher or lower.

Tax on compound interest

It’s worth remembering that like any income, compound interest earnings must be declared to the tax office, even if it’s savings for a child.

Who declares the interest earned, depends on who owns or uses the funds of that account. You can find out more about the tax requirements from the Australian Tax Office.

If you seek further discussion on this topic please contact us on PH: 0437 782 836.

1ASIC Money Smart Compound Interest Calculator – https://www.moneysmart.gov.au/tools-and-resources/calculators-and-apps/compound-interest-calculator

Important:

This information is provided by AMP Life Limited. It is general information only and hasn’t taken your circumstances into account. It’s important to consider your particular circumstances and the relevant Product Disclosure Statement or Terms and Conditions, available by calling PH: 0437 782 836, before deciding what’s right for you.

All information in this article is subject to change without notice. Although the information is from sources considered reliable, AMP and our company do not guarantee that it is accurate or complete. You should not rely upon it and should seek professional advice before making any financial decision. Except where liability under any statute cannot be excluded, AMP and our company do not accept any liability for any resulting loss or damage of the reader or any other person.