Introduction

“The nine most terrifying words in the English language are: I’m from the Government, and I’m here to help.” – Ronald Reagan

“We’re going to build factories again, put people to work making real products for American families, made with the hands of American workers. Together we will protect the wages of American workers…and we’re going to stamp more …products…’Made in the USA.’” – JD Vance

Introduction

2017 was a sad year as the last Australian-made car rolled off the production line in Elizabeth and I purchased my last Holden. Many workers at Holden and before that at Ford, Mitsubishi and elsewhere lost their jobs having a big impact on various communities. I could have argued for government support to keep the industry going and blamed politicians and foreigners for its demise. But I knew that it was not that simple. A key driver was that Australians – apart from a few nostalgists and others like me – had stopped buying Australian-made cars. So asking taxpayers via subsidies and car buyers via tariffs and quotas on imports to foot the bill to keep our car industry alive was fruitless. And that was pretty much the consensus that had prevailed since the 1980s as part of economic rationalist policies (often referred to as “neoliberalism”) that favoured free markets over government intervention as a better way to grow living standards. But support for economic rationalism started fraying in the aftermath of the GFC and as evident in Brexit and the rise of Trump. Since then, the backlash against economic rationalist policies has intensified with the rise of populism railing against the so-called elites that supported it. This potentially has longer term implications for investors.

The political pendulum swings to big government

Many things go in cycles. This is certainly true of politics and political support for economic policies. It’s been clearly evident over the last century with a swing in the political pendulum in one direction ultimately giving rise to a counter reaction in the other direction:

-

1930s-1970s – the catastrophic economic failure of the Great Depression gave rise to a fear of deflation and high unemployment and a scepticism of free markets. The political pendulum swung in favour of state intervention – partly influenced in the late 1930s by the apparent success of the USSR at the time and the rise of fascism in parts of Europe. In the US and Australia, it wasn’t so extreme – although there was rising intellectual support in the 1930s for communist and fascist policies – but it ushered in government industrial policies and heavy regulation which culminated in the economic disaster of the high tax, protectionism, growing state intervention and the welfare state of the late 1960s and 1970s that gave rise to stagflation in the 1970s.

-

1980s-2000s – stagflation and the failure of heavy government intervention then gave rise to popular support for the economic rationalist/right of centre policies of the 1980s. Thatcher, Reagan and Hawke and Keating ushered in a period of deregulation, freer trade, privatisation, lower marginal tax rates, tightened access to welfare, measures to reign in budget deficits and other supply side economic reforms designed to boost productivity. This was all helped along by the collapse of communism and the integration of China and former USSR countries into global trade. The political pendulum swung to neoliberalism and there was talk of “The End of History” with general agreement free market democracies were the way to go.

-

2010 – ongoing? – since the GFC the pendulum has been swinging away from economic rationalist policies. Slowly at first but now more rapidly. I thought it was initially part of a swing back to the left, but right-wing parties seem to be on board with it too.

What’s driving the backlash against neoliberalism?

There is no one factor but rather a range of forces, some of which seem contradictory. In particular: the feeling that the GFC indicated financial de-regulation had gone too far; several years of constrained and fragile economic growth made worse by the pandemic; stagnant real wages for median households in some countries – notably the US – made worse by cost-of-living pressures recently; high household debt levels preventing individuals from taking on more debt as a way to boost living standards; the reality and/or perception of rising levels of inequality; poor housing affordability; examples of big business doing the wrong thing; a backlash against immigration in Europe, the UK, the US and Australia; a backlash against globalisation and a feeling that workers in rich countries have been taken advantage of by foreigners; the success of macroeconomic stabilisation policies in the pandemic (like JobKeeper in Australia) driving expectations that government will always protect workers against an economic downturn; and economic reality not living up to ever rising expectations (whereas 40 years ago expectations were low).

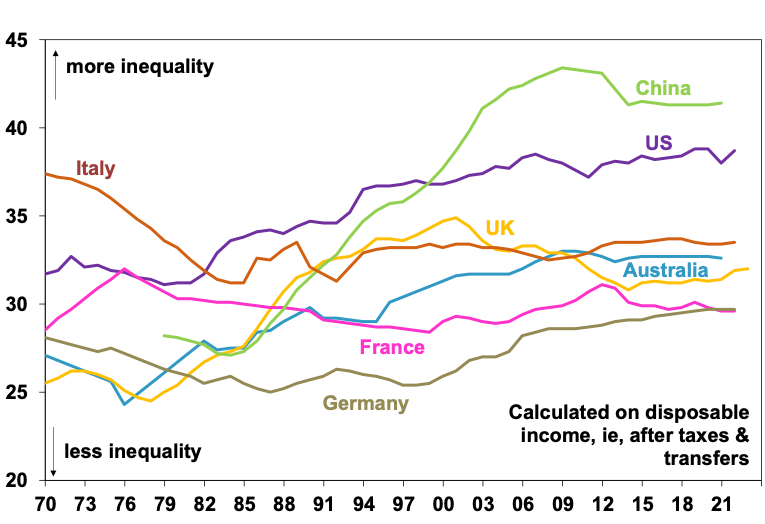

Rising inequality and perceptions of stagnant living standards are big ones. The next chart shows the Gini coefficient, which measures income inequality, calculated on incomes after taxes and transfers. It ranges from zero indicating perfect equality to one indicating perfect inequality with one household/individual receiving all income. As can be seen there has generally been a rising trend in inequality during the past 50 years. Surprisingly, it’s not evident in Italy and France, but is particularly evident in China (despite its socialism), and also the US, UK and Australia. Wealth inequality has also increased. Rising inequality may have been bearable in the 1990s and 2000s as nominal income was rising faster and households took on debt to boost their living standards. But this has become harder.

Income inequality – Gini coefficients over time

Source: Standardised World Income Inequality Database, AMP

The rise of populism

In this environment, charismatic populist politicians (think Trump, Le Pen and Farage) have been able to easily tap into voter grievance and argue the case for change against the “elites” and “foreigners”. It’s evident in: the Brexit vote and the rise of the right wing Reform UK party; Marine Le Pen’s National Rally in France which has gone from 11% of the vote in the 2017 national assembly election to 35% this year and at the other extreme the success of the left alliance; the right wing Brothers of Italy which now govern Italy; and Germany’s right wing Alternative for Deutschland coming second in German EU elections; and of course in the success of Trump and his makeover of the Republican Party in the US.

While these “movements” are disparate with the right also motivated by a backlash against climate action, immigration and identity politics and the left more focussed on income re-distribution, they offer a common rejection of free market economic rationalist policies and want a far more activist role for government in driving resource allocation, creating industries, ensuring high wages and protecting workers from foreigners. The experience of the stagflation of the 1970s and its causes and the failures of socialism as seen in the USSR should invite scepticism. But collective memories of those events have long ago dimmed, and populism thrives on simplistic claims devoid of genuine solutions (which is why populist strong men often turn to war to distract their populace).

Trump’s domination of the Republican Party is full of contradictions. His proposed use of tariff hikes to extend income tax cuts will hurt the ordinary Americans he claims to want to help. His income tax cuts and deregulation are reminiscent of Reagan’s supply side policies. But his running mate JD Vance comes across as a socialist with his commitment to the working man, protecting industry & attacks on foreigners & elites. His positioning as a successor to Trump in leading the MAGA movement appears to cement the Republican Party’s rejection of Reagan’s focus on free market forces. Reagan would likely regard him with terror as just another person “from the government” claiming to be “here to help”.

With populists snapping at their heals with simplistic solutions, even centrist governments will have to respond. This means more activist governments with industrial policies to bring factories back onshore, trade barriers and less immigration and measures to boost wages.

In this regard, it’s noteworthy that the Biden administration in the US has pushed heavily down this path promoting green industries and has maintained Trump’s protectionist policies with respect to China and is now trying to rein in illegal immigration. Australia is not immune from populism. Compulsory voting and the preferential voting system work against the rise of a far left or far right government here. But even here populist pressures are now driving more government intervention in the economy under the current government (e.g. the Future Made In Australia) and the Coalition also appears to be becoming more interventionist with a proposed renationalisation of the power industry in building nuclear power stations and threatening a break up of supermarkets.

But what does it all mean for investors?

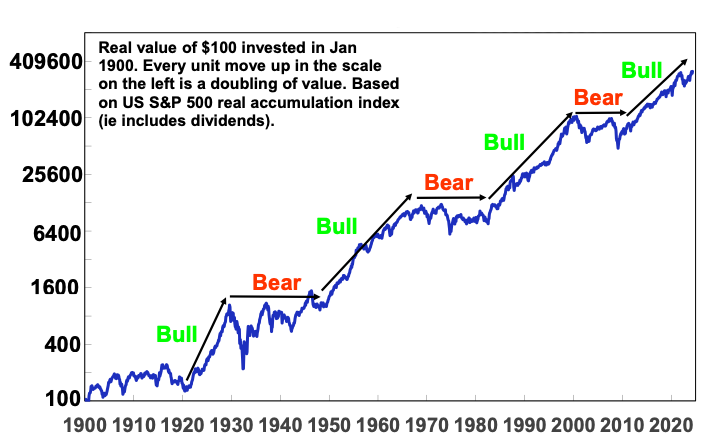

It’s worth putting this in context. The swing in the political pendulum to favour economic rationalist policies in the 1980s – deregulation, privatisation, smaller government, lower marginal taxes and globalisation – that followed along with the peace dividend from the collapse of communism, the IT revolution and attractively high starting points for dividend yields and bond yields created a powerful tail wind that drove strong returns in shares and bonds starting in the 1980s. This can be seen in the next chart which shows the value of $100 invested in US shares in 1900 allowing for the reinvestment of dividends and removing the impact of inflation. After the stagnation of the 1970s where real share market returns were around zero, that value of that investment surged in the 80s and 90s. It paused with the tech wreck and GFC in the 2000s, but the lagged effect of many of the same policies saw a new secular bull market from 2009.

Long term and bear phases in US shares

Since 1900 there have been four major secular bull markets in US shares: the 1920s; the 1950s and 60s; the 1980s and 90s; and since 2009. Source: Bloomberg, R Shiller, AMP

Now the environment is very different. Starting point price to earnings ratios are very high and we are seeing an accelerating reversal of economic rationalist policies in favour of more government involvement in economies and increasing protectionism. There may be some initial benefit from increased investment flowing from government industrial policies and protection but ultimately the misallocation of resources and higher costs associated with it risk slowing productivity growth and eventually resulting in higher inflation. The key point is that the powerful tailwind from the economic rationalist policies of the 1980s is now reversing and is likely to contribute to a more constrained return environment for investors.

Of course, it’s not all bleak. The populist far right is still polling less than 50% of the vote in Europe, some countries like Australia will be protected from populist extremes by their voting systems, market “riots” by bond investors (the so-called bond vigilantes) pushing up bond yields will make it hard for governments to implement irresponsible policies as seen repeatedly in Europe over the last decade and by the Truss government in the UK, technological innovation associated with AI offers a countervailing boost to productivity and central banks (assuming they stay independent) are better at keeping medium-term inflation down now than in the 1970s.

Dr Shane Oliver – Head of Investment Strategy and Chief Economist, AMP

Source: AMP Capital July 2024

Important note: While every care has been taken in the preparation of this document, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) make no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided.