Investing success can mean different things to different people. Being clear on what success means for you is key to mapping out your plan.

Although investing can seem perplexing and complex, success is largely within your control.

Having a tailored investment strategy can go a long way to reducing the stress and noise associated with investment decisions.

Vanguard has four guiding principles designed to help investors focus on what’s important to them and give them the best chance for investment success.

1. Create clear, appropriate investment goals

There is no one-size-fits-all plan for reaching financial objectives. Goals are unique to your situation, preferences, and aspirations.

Identifying and prioritising your financial intentions allows you to focus on what matters most, in an order that works for you. It also helps you decide where you’re willing to compromise.

Once you set and prioritise your goals you can figure out how much—and for how long—you’ll need to save.

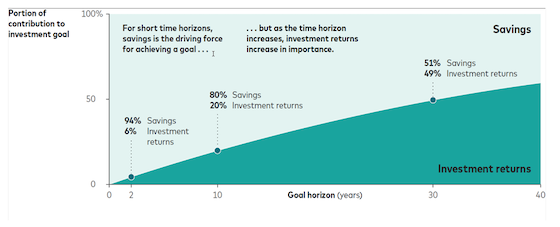

The value any portfolio achieves over time is the sum of two elements: savings (the amount you put into your portfolio) and investment returns. Much of the discussion about investment success tends to focus on investment returns, but both elements are crucial in reaching a goal.

Time is a key factor here. For short time horizons, savings—which is within your control—is the driving force in achieving an investment goal. As the time horizon increases, investment returns increase in importance.

Savings and investment returns both contribute to the achievement of any investment goal

Over any given goal horizon, an investment balance is the sum of savings (the amount you put into your investment portfolio) plus the investment returns on the total amount invested.

Notes: The calculation for the contribution of savings and investment returns is as follows: Assuming a 4% real return (after inflation), we calculate how much an investor needs to invest annually to achieve a given investment goal for different time horizons, varying from 0 years (now) to 40 years. Savings represent the amount invested (the principal). Contributions are assumed to be the same every year relative to the year investing begins.

Source: Vanguard

2. Keep a balanced and diversified mix of investments

Shares can be risky, but so is avoiding them. While they can be more volatile in the short run, historically they’ve outperformed cash-equivalent assets in the long run.

Investors can reduce overall portfolio volatility while also safeguarding against unnecessarily large losses by spreading their investments across shares and bonds and among sectors and countries.

An appropriate asset allocation takes into account your risk tolerance—how much volatility you can tolerate in your portfolio—and risk capacity—your ability to withstand a loss in your portfolio (a reflection of your time horizon and cash flow needs).

Factoring in your time horizon and your tolerance for risk can lead to a tailored portfolio that’s suitable to personalised situations.

3. Minimise costs

Market movements and financial returns are hard to predict, but costs are often controllable. The two broad types of costs that you can minimise are (1) taxes and (2) investment costs, which include expense ratios, transaction costs, and sales charges.

Together, these costs cut into investment returns, sometimes significantly. To reduce these expenditures, and help improve returns, you can:

-

Seek out lower-cost funds. The higher the investment costs, the higher the odds of market underperformance. Lower-cost investment funds have historically outperformed higher-cost investment funds.

-

Implement tax-advantaged and tax-efficient investment strategies, where available. These strategies could include contributing more concessional contributions into your superannuation, which are taxed at 15%, minimising transaction activity to avoid triggering capital gains tax liabilities, and having a strategic plan for tax-efficient asset location

4. Maintain perspective and long-term discipline

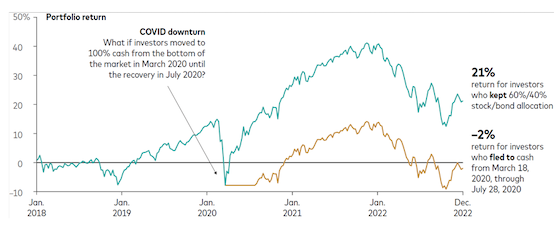

Discipline in investing is the ability to adhere, over time, to an investment plan. It’s natural to want to react to market volatility, but acting on that emotion can lead to an impulsive decision, like panic selling during an unstable market.

Taking a long-term perspective can help you maintain discipline and avoid a potentially harmful emotional move.

Reacting to market volatility can jeopardise returns

What if investors shifted to cash at the bottom of the COVID downturn and stayed there until the market recovered?

Notes: Stocks are represented by the MSCI All Country World Index; bonds are represented by the Bloomberg Global Aggregate Bond Index (USD Hedged). Cash is represented by the Bloomberg U.S. Treasury 1–3 Month U.S. Treasury Bill Index. Returns are in nominal terms.

Sources: Vanguard calculations, using data from Morningstar, Inc.

Past performance is no guarantee of future returns. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.

Staying the course can help increase your chance of success, but so can other actions, like making regular contributions to your portfolio, and increasing them over time.

Other actions that can increase the likelihood of reaching an investment goal including having a consistent plan to rebalance your portfolio, a disciplined spending strategy, and a regularly scheduled date to monitor and review your goals.

Vanguard’s four principles can help you focus on the aspects within you control so you can build tailored plans to help you achieve long-term investing success.

Source: Vanguard January 2024

This article has been reprinted with the permission of Vanguard Investments Australia Ltd. Copyright Smart Investing™

Important information and general advice warning

Vanguard Investments Australia Ltd (ABN 72 072 881 086 / AFS Licence 227263) is the product issuer and the Operator of Vanguard Personal Investor. We have not taken your objectives, financial situation or needs into account when preparing this article so it may not be applicable to the particular situation you are considering. You should consider your objectives, financial situation or needs, and the disclosure documents for any financial product we make available before making any investment decision. Before you make any financial decision regarding Vanguard products, you should seek professional advice from a suitably qualified adviser. A copy of the Target Market Determinations (TMD) for Vanguard’s financial products can be obtained at vanguard.com.au free of charge and include a description of who the financial product is appropriate for. You should refer to the TMD before making any investment decisions. You can access our IDPS Guide, PDSs, Prospectus and TMDs at vanguard.com.au or by calling 1300 655 101. Past performance information is given for illustrative purposes only and should not be relied upon as, and is not, an indication of future performance. This article was prepared in good faith and we accept no liability for any errors or omissions.

2024 Vanguard Investments Australia Ltd. All rights reserved.